UAE MARKET

Competition Analyse Report

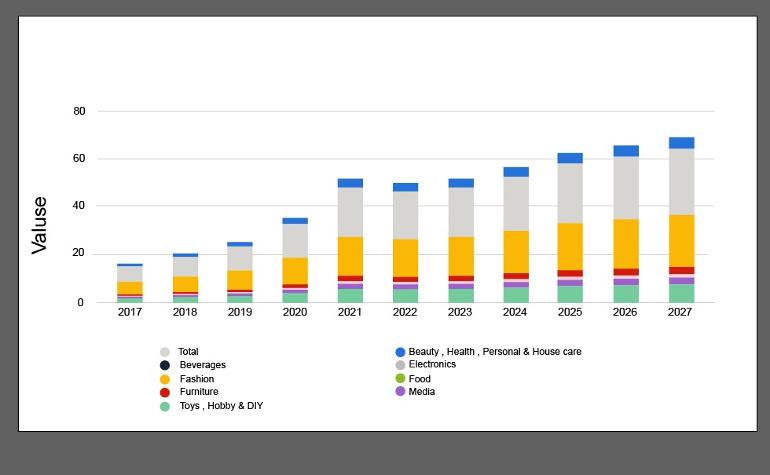

- Revenue in the eCommerce market is projected to reach US$10.37bn in 2023.

- Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 7.66%, resulting in a projected market volume of US$13.93bn by 2027.

- With a projected market volume of US$1,308.00bn in 2023, most revenue is generated in China.

- In the eCommerce market, the number of users is expected to amount to 7.32m users by 2027.

- User penetration will be 0.0% in 2023 and is expected to hit 74.6% by 2027.

- The average revenue per user (ARPU) is expected to amount to US$0.00.

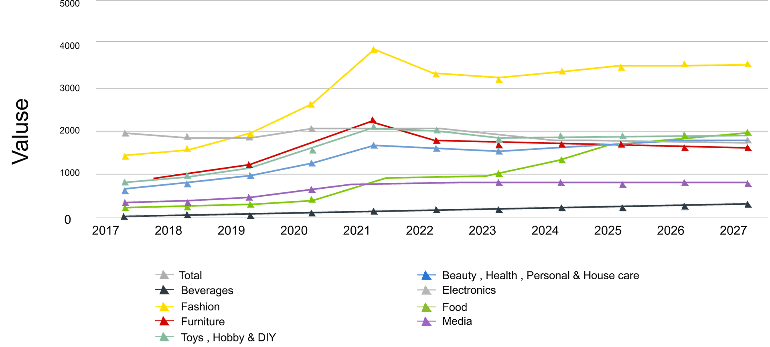

In the last decade, the eCommerce market has evolved from a simple concept of brick-and-mortar retail to a shopping ecosystem that involves multiple devices and store concepts. Many players from both online and offline retail are moving towards multi-channel strategies and are continuously reinventing the way we shop online. Expectations are growing rapidly as customers discover more convenience on all levels – be it product customization, mobile-optimized search, quick checkout processes, or hassle-free delivery.

In 2021, the percentage of consumers who made at least one purchase online in the previous 12 months grew to 74% of population in the U.S., 81% in the UK, and 69% in China. In developed countries, the market is in its maturity phase, and the competition among eCommerce players is extremely high and cost-intensive. Marketplaces such as Amazon and AliExpress are flourishing, while many stand-alone retailers struggle to find their USP, as brand and store loyalty are decreasing and the cart abandonment rate in the industry is high. Increasing brand engagement can be achieved through community building (e.g., ASOS Marketplace), loyalty programs, and a seamless mobile and desktop user experience.

Chinese key market players such as Alibaba Group, JD, and Pinduoduo jointly contribute to the comprehensive eCommerce ecosystem in China – and are increasingly penetrating other promising Asian markets, such as Indonesia and India. The Chinese population is tech-savvy and mobile-first, and Chinese eCommerce giants are therefore constantly pushing technology forward. They have diversified into literally every sphere that comes in touch with online retail, from payments to logistics. Current developments in China will – to a large extent – define the next decade’s global eCommerce.

Sales Channels

OFF LINE

ON LINE

PLATFORMS

.

THIRD PARTY

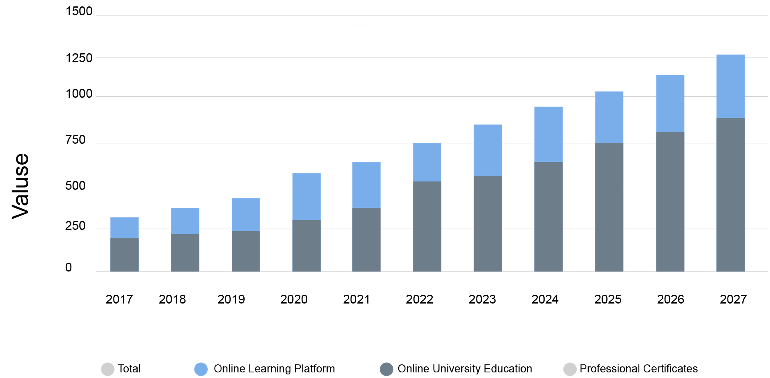

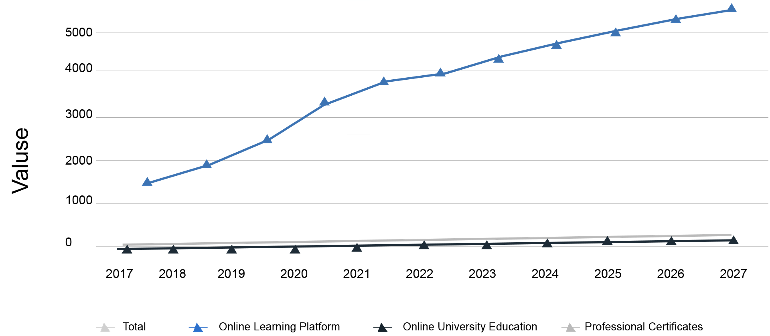

EDUCATION MARKET

- Revenue in the Online Education market is projected to reach US$166.60bn in 2023.

- Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 9.48%, resulting in a projected market volume of US$239.30bn by 2027.

- The market's largest segment is Online University Education with a projected market volume of US$103.80bn in 2023.

- In global comparison, most revenue will be generated in the United States (US$74,800.00m in 2023).

- The average revenue per user (ARPU) in the Online Education market is projected to amount to US$0.21k in 2023

Analyst Opinion

The Online Education segment is currently facing several major trends and issues. Firstly, the rapid shift towards remote learning due to the COVID-19 pandemic has resulted in an increase in demand for online education services. Secondly, there is a growing trend towards personalized and adaptive learning, with online education platforms incorporating AI and machine learning technologies to offer customized learning experiences. The effects of these trends are seen in the numbers, with the global online education market expected to reach $325 billion by 2025, growing at a compound annual growth rate of approximately 7%. Additionally, the COVID-19 pandemic has accelerated the adoption of online education, with the number of enrolled students in online courses increasing significantly in the past year. Going forward, the online education segment is expected to continue its growth trajectory, driven by the increasing demand for remote and flexible learning options, as well as the advancements in technology that allow for more personalized and engaging learning experiences. However, the industry may also face challenges such as ensuring the quality and accreditation of online courses, and addressing the digital divide and unequal access to technology and internet connectivity. Nevertheless, the overall outlook for the online education segment remains positive, with strong growth potential in the coming years.

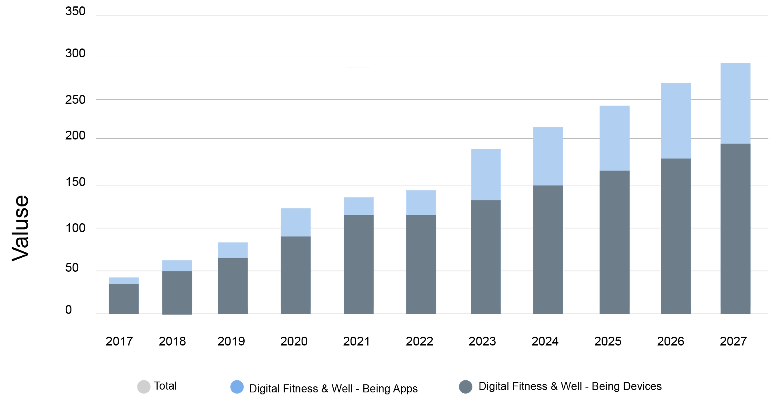

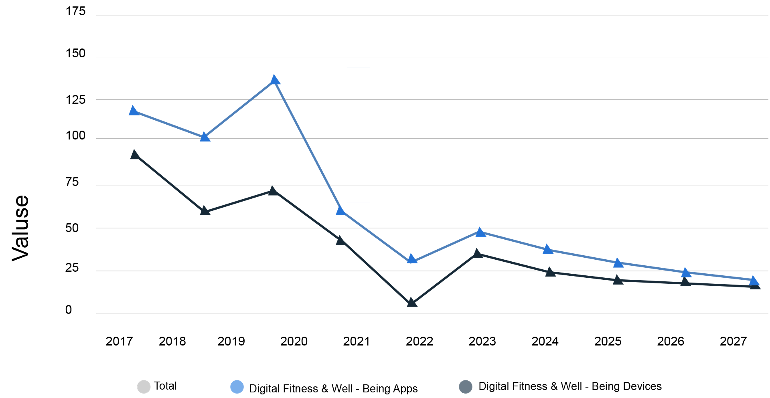

Digital Fitness & Well-Being

- Revenue in the Digital Fitness & Well-Being segment is projected to reach US$96.94bn in 2023.

- Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 10.93%, resulting in a projected market volume of US$146.80bn by 2027.

- User penetration will be 18.56% in 2023 and is expected to hit 22.20% by 2027.

- The average revenue per user (ARPU) is expected to amount to US$68.00.

- In global comparison, most revenue will be generated in China (US$31,780.00m in 2023).

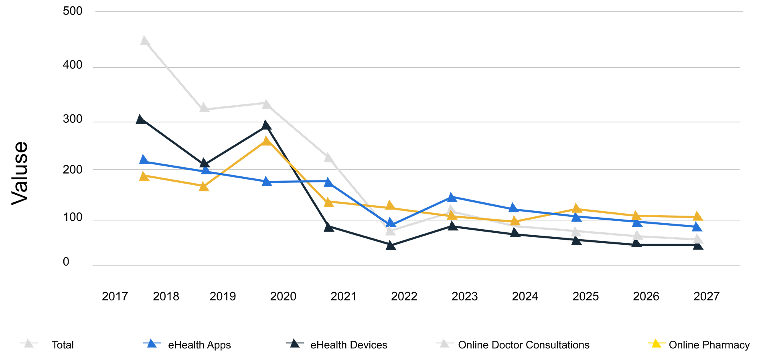

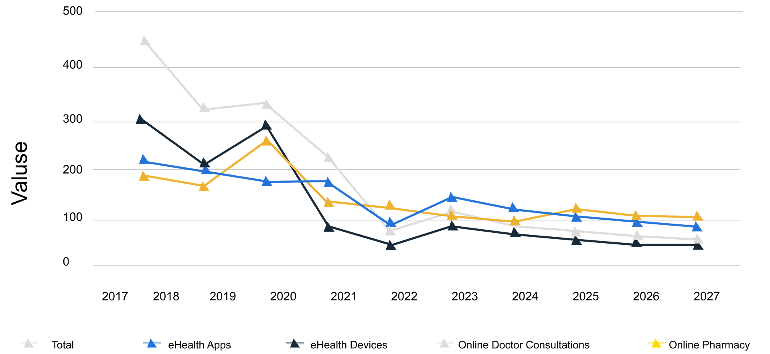

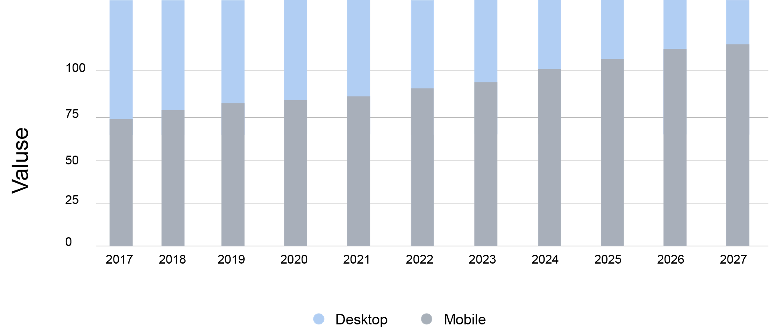

E-Health

- Revenue in the eHealth segment is projected to reach US$73.21bn in 2023.

- Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 10.59%, resulting in a projected market volume of US$109.50bn by 2027.

- User penetration will be 27.87% in 2023 and is expected to hit 36.12% by 2027.

- The average revenue per user (ARPU) is expected to amount to US$34.19.

- In global comparison, most revenue will be generated in China (US$23,270.00m in 2023).